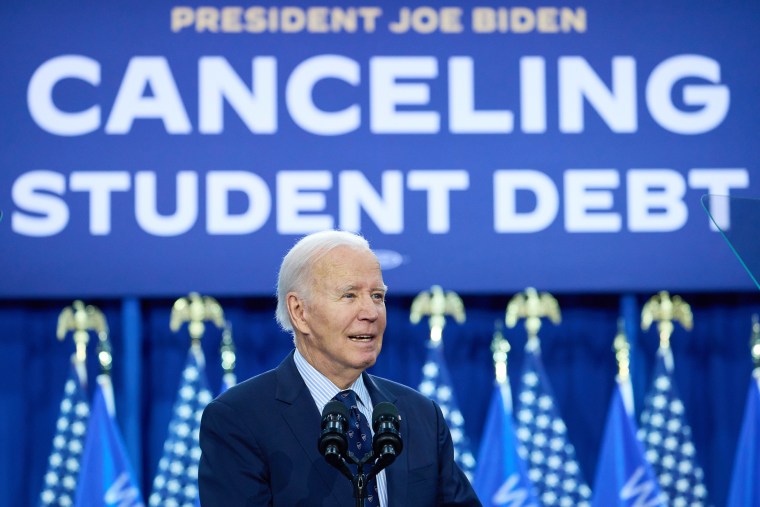

WASHINGTON — The Supreme Court on Wednesday rejected a petition by the Biden administration seeking to renew a recent plan to tackle federal student loan debt.

In a summary order, the court denied an emergency motion filed by the administration to lift the nationwide ban imposed by the appeals court. There were no significant differences of opinion.

The order said the appellate court, which is currently handling the case, “must deliver its decision with appropriate dispatch”.

In July 2023, the next month after the Supreme Court ruled that the administration lacked the authority to implement President Joe Biden’s previous debt forgiveness program, the Education Department issued a regulation that would end its prestigious Tuition or Save program.

The new initiative, like the previous one, was challenged by several conservative-leaning states, led by Missouri.

“This court order is a stark reminder to the Biden-Harris administration that Congress did not give them the power to make working Americans pay off someone else’s $500 billion in Ivy League debt,” Missouri Attorney General Andrew Bailey said in a statement. “This is a huge win for every American who still believes in paying their own way.”

A spokeswoman for the Department of Education said the administration will continue to push for lower repayment options for borrowers.

“We are disappointed in this decision, especially since lifting the ban will allow borrowers across the country lower down payments and other benefits,” the spokesperson said in a statement. “While we await a final decision from the Eighth Circuit, the Department will work to minimize further harm and disruption to borrowers.”

The new proposal contains several provisions, including one that would limit the amount people must repay to 5% of their income for undergraduate loans. Earlier this limit was 10%.

Challengers said it would require up to $475 billion in spending not authorized by Congress. They say it should be blocked for the same reason the Supreme Court blocked Biden’s earlier plan.

Under the “vital questions” doctrine adopted by the Court’s conservative justices, federal agencies cannot initiate new policies with significant economic consequences without the express authorization of Congress.

The states argued in court papers that the Biden administration’s “insistence on unfettered authority to cancel every penny of every debt is staggering.”

Other provisions in the new plan would put limits on accrued interest and shorten the repayment period for some smaller loans before allowing them to be forgiven.

The states sued to block the program in April, only for a federal judge in Missouri to stay the shortened repayment plan.

But in an Aug. 9 ruling, the St.Louis-based 8th US Circuit Court of Appeals issued a more stringent injunction, suspending other provisions.

In court documents, Solicitor General Elizabeth Preloger said changes in repayment amounts are allowed under a 1993 federal law that says the education department can determine an “appropriate portion” of income to calculate payment amounts and set repayment deadlines.

He said the “overwhelmingly broad” appeals court block goes beyond the new plan and prevents implementation of earlier changes to repayment terms from 1994, thereby “disrupting the settled expectations of borrowers who have paid for years or even decades.”

About 8 million people are already enrolled in the SAVE program, and other rules previously in place allowed for lower reimbursements.

The plan has also been challenged in other courts, with judges blocking parts of it. But the 8th Circuit’s decision has made those cases less relevant.

For that reason, the Supreme Court on Wednesday dismissed separate petitions filed by various states challenging the plan.